How Retirement Income Planning can Save You Time, Stress, and Money.

Table of ContentsThe Best Guide To Retirement Income PlanningThe Ultimate Guide To Retirement Income PlanningMore About Retirement Income PlanningThings about Retirement Income Planning

A retired life revenue strategy is actually a year by year timetable that reveals you where your retirement income will originate from. It could be performed on a sheet of graph newspaper, or even quite simply in an Excel spreadsheet (or even one more spreadsheet plan). Here are four easy steps you can utilize to make one.You may see an example retirement life income planning on the dining table at the bottom of this article. Add cavalcades for each source of set income such as: Program the amount starting in the year/age you intend to start perks as well as proceed this life expectations.

Series the quantity starting in the year/age your partner will definitely start advantages and also proceed it by means of their life span. If there is actually a grow older or health distinction between the two of you always remember that upon the initial death, the enduring significant other maintains the larger of their personal Social Surveillance or their spouse's.

Program the volume beginning in the year/age you prepare to take it. A separate pillar is made use of for every resource of pension profit. In some instances, the funds from retired life profiles, pensions, and Social Safety and security advantages change located on when you pick to start the distributions. Talk to your program consultant, or the SSA site for regulations that relate to you.

A Biased View of Retirement Income Planning

A different column is utilized for each source of pension revenue. If married, help make sure you account for the pension heir alternative that was actually chosen. Input this just if you have an annuity that will definitely spend you an ensured minimum amount starting at a particular grow older or even date, with the payment proceeding for life, shared life, or even for a collection amount of time.

Perform not input financial investment revenue sources including rewards, interest, or funding gains. Instead, you will certainly use your retired life revenue planning to work out just how much you will definitely need to have to remove coming from your economic accounts. When it comes to drawbacks, browse through the 1,000-Bucks-a-Month Guideline to reverse-engineer the amount of you need to have to conserve for retirement - retirement income planning.

Listing items such as a home mortgage that may be actually paid in a handful of years in a distinct cavalcade. In the instance at see here now the bottom of the webpage, you find the home mortgage will definitely be paid midway via 2025, to ensure year the total annual mortgage loan settlement is 50% of what it was actually the year just before, and then that expense leaves.

Some Known Facts About Retirement Income Planning.

The list below year they will certainly have much more Social Surveillance income and determined they would just require about a $15,000 IRA drawback. Next, your retirement life earnings plan need to determine the void, which is a deficit to be removed from cost savings, or even an excess accessible to be deposited to cost savings.

If this "Gap" is a bad number, this is what you would certainly require to remove from cost savings and also expenditures to have your preferred retired life way of living. If the "Void" is actually an excess then you have enough fixed resources of profit to meet your wanted retirement way of living and could include to financial savings or probably spend a bit much more.

A non-traded REIT is actually a kind of realty assets that allows you to acquire an expertly handled profile of business realty. This is actually a non-liquid resource that financiers commonly hold for the regard to the depend on up until it is actually liquidated by the management crew. It is different from publicly-traded REITs, which may be gotten as well as sold on social markets.

"Non-traded REITS are certainly not impacted by day-to-day rate dryness as is actually the situation along with publicly-traded REITs," claims Haworth. Possible to produce earnings from genuine estate without having to be actually responsible for dealing with the homes.

The Best Guide To Retirement Income Planning

A frequent flow of earnings (in the go to my blog majority of kinds of non-traded REITs). Diversification for a profile produced up largely of equities and bonds.

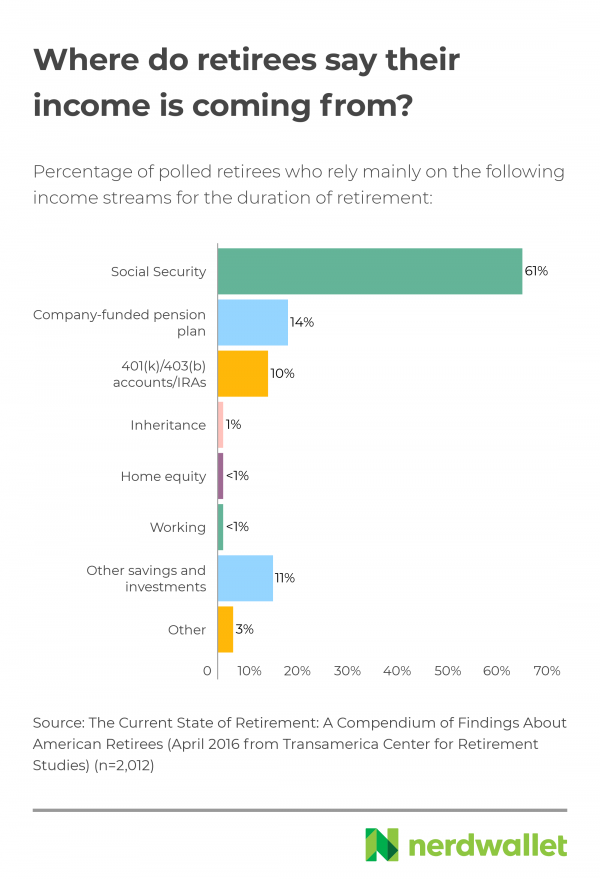

This is a fundamental resource of revenue for many folks. When you decide to take it may have a significant impact on your retired life.

(FRA varieties coming from 66 to this post 67, relying on the year through which you were actually born.) Figure out your full old age, and also deal with your economic specialist to look into how the timing of your Social Safety advantage matches your overall plan. Pensions used to be actually widespread, they aren't so a lot any longer.